Resources

An email from the Tax Office. A threat that is a bit different than expected.

Written by RMPersonnel on 07/18/2018.

You open your mailbox and your adrenaline suddenly rises. The first unread email is from John Smith from the American IRS. What do these people want from me, you ask yourself. You are trying to remember the last few times you filed your taxes and your heart is beating faster and faster by the minute. However, there might not be a reason to panic and you might do yourself a favour by reading the message really carefully first. Why is that?

A scamming method called phishing

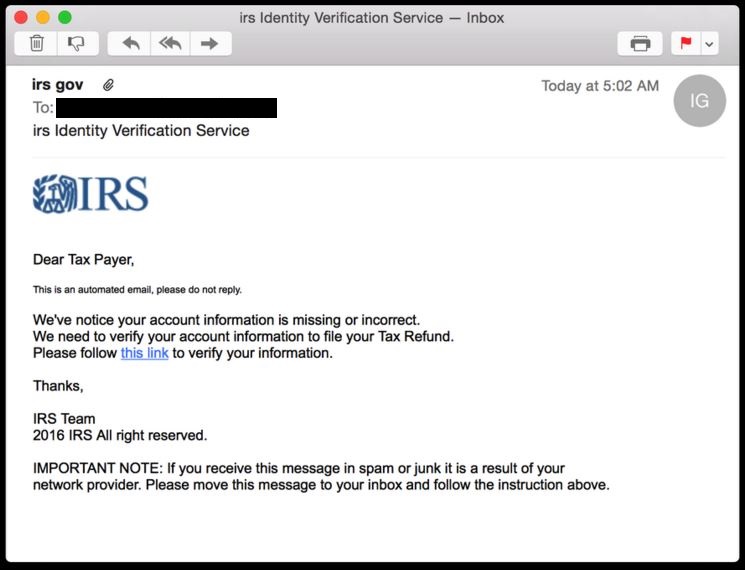

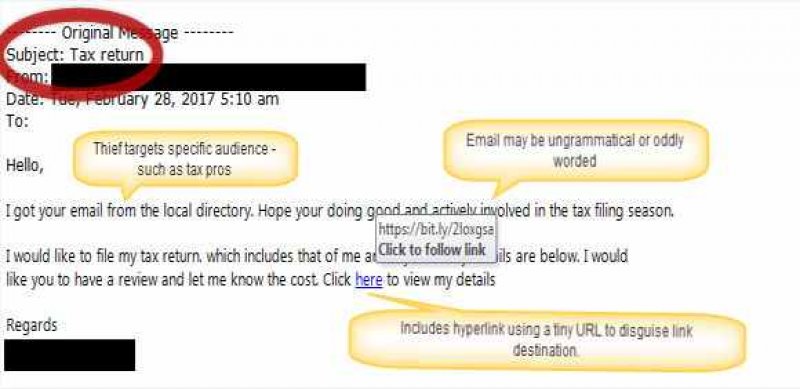

The email might be fraudulent. The technical term for this type of fraud is “phishing”. This technique is used to gain valuable information from the scammer’s victims. This information will then be used to benefit the scammer in numerous ways, most commonly to steal financial assets from a bank account using stolen information such as a card number, social security number, etc.

How do you recognize such an email? The first hint might be a strange email address from which the email came. The text will often be full of grammar mistakes, links to other strange domains that are full of grammar errors and the “official” email will usually have an extremely common name. The email will often have files attached to it. Even though these very obvious cues should tip everyone off that this might not be the real IRS contacting them, some people still feel a sense of trust and the need to sort this issue immediately. Hundreds of people fall prey to these scams daily.

What role does the IRS play in all of this?

One of the most common forms of phishing is copying emails from government institution. Whenever you see an email coming from the government, you often feel afraid of not obeying the law and will usually try to resolve this issue ASAP. This usually leads to people opening the email and doing everything the scam artist tells them to do.

Some time ago, the IRS reported a rise in the number of fraudulent emails. In response to this, the agency issued a statement reminding tax payers that whenever they are contacted by mail, internet or by a text message, the agency will never request personal information. So, a clerk from the tax office may contact you by email, but he will never ask you for your personal information.

3 ways to reach you

According to IRS, scammers most commonly use the aforementioned media. For each of these channels, the IRS created a series of recommendations of what to do when scammers contact you. The IRS also asks the victims of these attacks to send them all of the fraudulent emails.

The scammers frequently try to contact their victims via email. If you spot the fraudulent email right at the start, from the subject that pops up on, don’t even open it. If the text includes links to any websites, don’t click on them. Also, don’t download any attachments since they could put a virus on your computer. Forward the email to phishing@irs.gov and delete it permanently from your mailbox.

Use the same level of caution if you happen to stumble upon a website with an IRS theme that simply seems “off”. In this case, IRS is asking you to send a link to this site via the aforementioned email address. The same rules apply – don’t click on anything, don’t put in your personal information and don’t download anything.

IRS does not use text messages to contact tax payers, so if you get a text message, be careful. The text messages are very similar to emails – they mainly include grammatical errors. Don’t respond to these texts and don’t open any links or attachments. If you can, send the content of the message and the number of the scammer to 202-552-1226. After you do this, delete the message from your phone.

Critical thinking is your best defence

Sometimes, it can be tough to spot a fraudulent message. Sometimes the scammers don’t even try. The fraudulent emails are of differing quality, so if you are at odds, contact the IRS via your phone and ask them, whether or not they sent the email. Don’t believe the alarming statements that you only have a few hours to pay. So, your best defence against such tactics is to stay calm, use your critical thinking and prevent the scammers from getting your personal info by not providing it to them.

Go back

>> Meat Handler 2nd Shift

>> Meat Handler 2nd Shift >>

>>  >>

>>